Tax records are public information and can be pulled for any residential property. You can find them online at the State Department of Assessments and Taxation. In some areas, additional research is required and you have to do more than just plug in an address. For example, newly constructed homes often do not have the house number recorded and are listed solely under the street name.

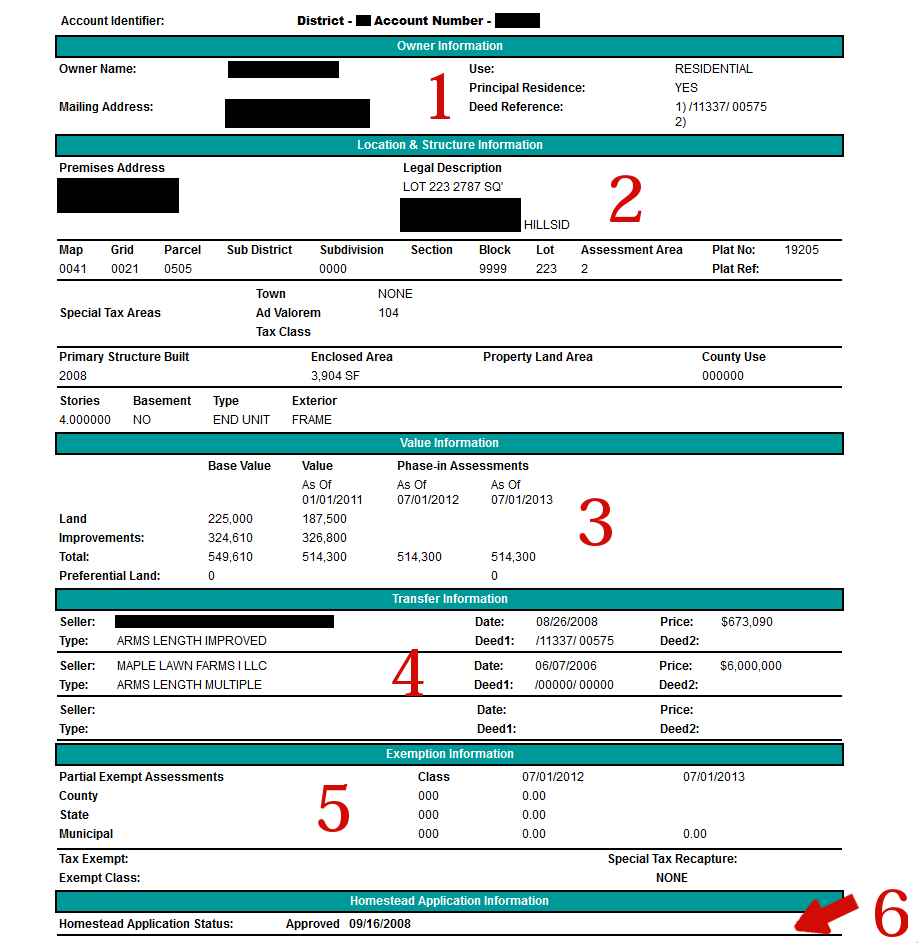

Once you search for a property in a particular county your results will give you all kinds of juicy information. Not sure what some of the information is trying to tell you? Here’s a breakdown of what each section means. We decided to highlight a few items for you below (we’ve blocked out some of the information to protect the identity of the innocent):

Section 1:

Principle Residence: This tells you if the property is owner occupied. A “No” would indicate that this property could be a rental property or it might be owned by a company.

Section 2:

Sometimes the premise address differs from the mailing address, either because the property is an investment property or the postal service guidelines require an adjustment. The legal description is how the property is described on the deed. It could be a metes & bounds description or an actual lot/block/subdivision description. It differs for every area.

The town section is only filled out if your property lies in an incorporated municipality. Ad valorem tells you which tax district the property falls under. The tax class applies to areas in Prince George’s and Montgomery Counties that are special tax areas (how special can you get?).

The enclosed area is the square footage for the property and does not include the basement. It’s technically everything that lies above ground since the lower level is not considered living space (even if it is finished). Appraisers also define the square footage in this way and they have a separate line item adjustment for finishes in a basement.

Section 3:

This is the assessed value of the property for tax purposes. Remember that the tax assessor is not nearly as accurate as an appraiser would be in determining the value of your home. Assessments are revised on a 3 year cycle so they are always behind the current market. If your home is assessed at a value that is higher than the actual value of your home, you can appeal the taxes.

Section 4:

Though this is not the case for every property, you can see that the first transfer of this home was for $6,000,000. This amount is actually not for this specific property – it was the amount the developer paid for all of the land before subdividing into individual lots. You may also see transfers with an amount of $0. This often indicates a refinance.

Section 5:

Shows any exemptions that the property may be receiving.

Section 6:

We have reminded many people to apply for the Homestead Tax Credit. This section will tell you the status of your application. More about that here.

Looking for additional information on a property? Contact us!